About Income Tax

Income Tax Basics

Everyone who earns or gets an income in India is subject to income tax. (Yes, be it a resident or a non-resident of India ). Also read our article on Income Tax for NRIs. Your income could be salary, pension or could be from a savings account that’s quietly accumulating a 4% interest. Even, winners of ‘Kaun Banega Crorepati’ have to pay tax on their prize money. For simpler classification, the Income Tax Department breaks down income into five heads:

| Head of Income | Nature of Income covered |

|---|---|

| Income from Salary | Income from salary and pension are covered under here |

| Income from Other Sources | Income from savings bank account interest, fixed deposits, winning KBC |

| Income from House Property | This is rental income mostly |

| Income from Capital Gains | Income from sale of a capital asset such as mutual funds, shares, house property |

| Income from Business and Profession | This is when you are self-employed, work as a freelancer or contractor, or you run a business. Life insurance agents, chartered accountants, doctors and lawyers who have their own practice, tuition teachers |

Taxpayers and Income Tax Slabs

Taxpayers in India, for the purpose of income tax includes:

- Individuals, Hindu Undivided Family (HUF), Association of Persons(AOP) and Body of Individuals (BOI)

- Firms

- Companies

Each of these taxpayers is taxed differently under the Indian income tax laws. While firms and Indian companies have a fixed rate of tax of 30% of profits, the individual,HUF, AOP and BOI taxpayers are taxed based on the income slab they fall under. People’s incomes are grouped into blocks called tax brackets or tax slabs. And each tax slab has a different tax rate. In India, we have four tax brackets each with an increasing tax rate.

- Income earners of up to 2.5 lakhs

- Income earners of between 2.5 lakhs and 5 lakhs

- Income earners of between 5 lakhs and 10 lakhs

- Those earning more than Rs 10 lakhs

| Income Range | Tax rate | Tax to be paid |

|---|---|---|

| Up to Rs.2,50,000 | 0 | No tax |

| Between Rs 2.5 lakhs and Rs 5 lakhs | 5% | 5% of your taxable income |

| Between Rs 5 lakhs and Rs 10 lakhs | 20% | Rs 12,500+ 20% of income above Rs 5 lakhs |

| Above 10 lakhs | 30% | Rs 1,12,500+ 30% of income above Rs 10 lakhs |

This is the income tax slab for FY 2017-18 for taxpayers under 60 years. There are two other tax slabs for two other age groups: those who are 60 and older and those who are above 80.

A word of note: People often misunderstand that if they earn let’s say Rs.12 lakhs, they will be paying a 30% tax on Rs.12 lakhs i.e Rs.3,60,000. That’s incorrect. A person earning 12 lakhs in the progressive tax system, will pay Rs.1,12,500+ Rs.60,000 = Rs. 1,72,500.

Check out the income tax slabs for previous years and other age brackets.

A word of note: People often misunderstand that if they earn let’s say Rs.12 lakhs, they will be paying a 30% tax on Rs.12 lakhs i.e Rs.3,60,000. That’s incorrect. A person earning 12 lakhs in the progressive tax system, will pay Rs.1,12,500+ Rs.60,000 = Rs. 1,72,500.

Check out the income tax slabs for previous years and other age brackets.

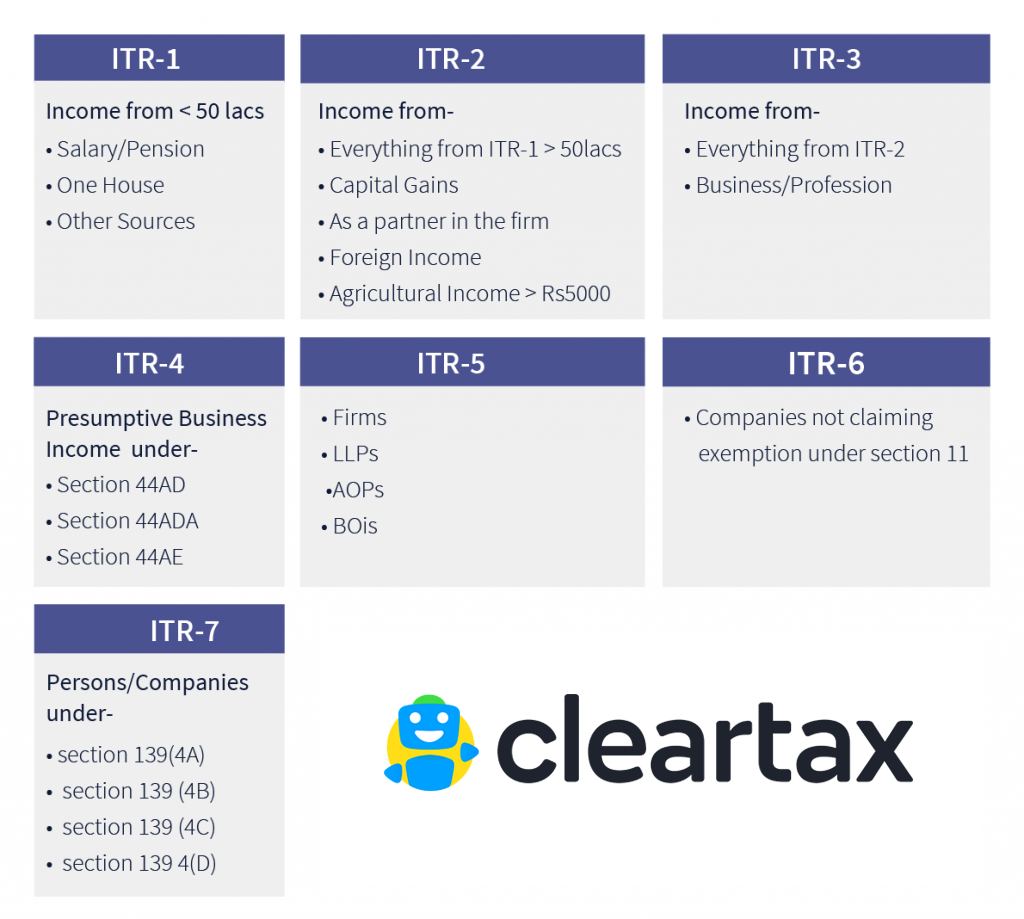

ITR Forms

ITR forms i.e. the return filing forms have been prescribed differently based on the class of taxpayers and the source of income. See below for further clarity

Documents Required for ITR Filing

Form 16, Form 26AS, Form 16A, proof of tax saving investments made, bank account details etc are some of the crucial details / documents that you need to be ready with before filing your return. Further the documents you are going to need to file your tax return are largely going to depend on your source of income. Here is our detailed article on documents you need for filing of your return of income

Advance Tax

Self-employed people must do the calculation themselves and pay the tax to the Government periodically every quarter.The deadlines are:

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

No comments: